Tax percentage calculator paycheck

The tax rate displayed is an assumption that may or may not be relevant to your situation. It can also be used to help fill steps 3 and 4 of a W-4 form.

Salary To Hourly Salary Converter Salary Hour Calculators

In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability.

. These steps will leave you with the percentage of taxes deducted from your paycheck. In Gilpin County for example where homeowners there pay about 791 annually in property taxes the rate is just 023. In some areas effective property taxes are even lower.

The percentage method and the aggregate method. A paycheck calculator allows you to quickly and accurately calculate take-home pay. This is the percentage that will be deducted for state and local taxes.

Plus the paycheck tax calculator includes a built-in state income tax withholding table. The states average effective property tax rate property taxes paid as a percentage of home value of 049 is one of the lowest in the US. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

It only takes a few seconds to calculate the right amount to deduct from each employees paycheck thus saving you time and providing peace of mind. Aggregate method There are two ways to calculate taxes on bonuses. With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

How much tax is taken out of a paycheck. Use PaycheckCitys bonus tax calculator to determine how much tax will be withheld from your bonus payment using supplemental tax rates. Simply select your state and the calculator will fill in your state rate for you.

In 2022 the federal income tax rate tops out at 37. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Employer Paid Payroll Tax Calculator.

Please note this calculator can only estimate your state and local tax withholding. The more someone makes the more their income will be taxed as a percentage. Note that the default rates are based on the 2022 federal withholding tables IRS Publication 15-T 2022 Percentage Method Tables pg 10 but you can select prior years.

PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals small businesses and payroll professionals every year. A bonus paycheck tax calculator can help you find the right withholding amount for both federal and state taxes. If you think you qualify for this exemption you can indicate this on your W-4.

This year you expect to receive a refund of all federal income tax withheld because you expect to have zero tax liability again. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. We multiply your calculated taxable icome by this rate to estimate your state and local taxes.

This varies from person to person and location to location. For example the more money you earn the more you pay in taxes.

What Are Marriage Penalties And Bonuses Tax Policy Center

Payroll Calc Store 50 Off Www Ingeniovirtual Com

Tax Calculator For Wages Store 52 Off Www Ingeniovirtual Com

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll Calc Store 50 Off Www Ingeniovirtual Com

Payroll Tax What It Is How To Calculate It Bench Accounting

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Texas Income Tax Calculator Smartasset

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

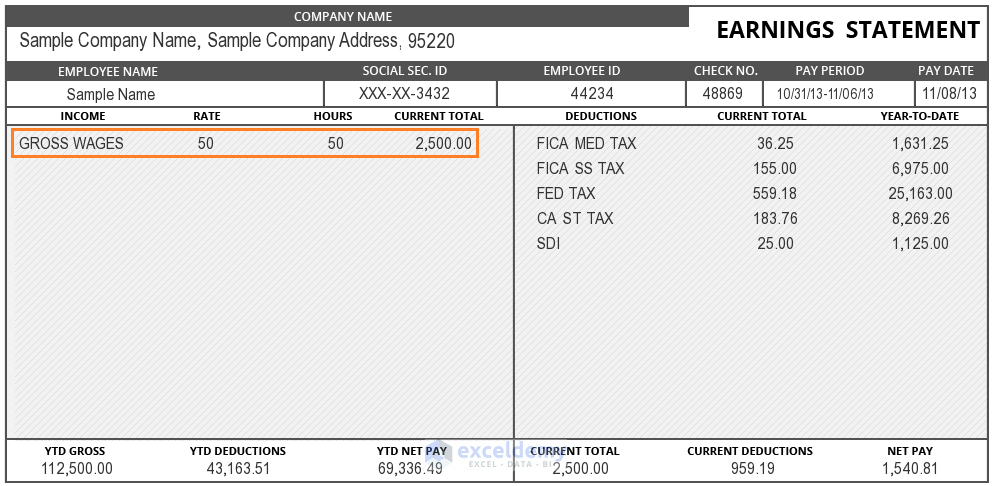

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Calc Store 50 Off Www Ingeniovirtual Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com

Pay Raise Calculator

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How To Calculate Salary Increase Percentage In Excel Free Template