Total gross income calculator

Was this site helpful. Income From Salary- Add the total gross salary received from the.

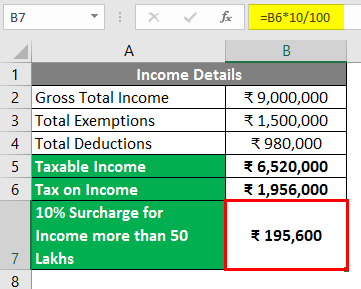

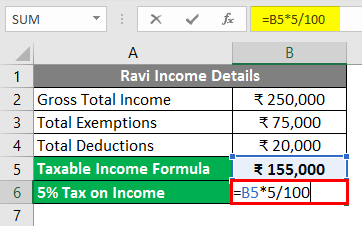

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

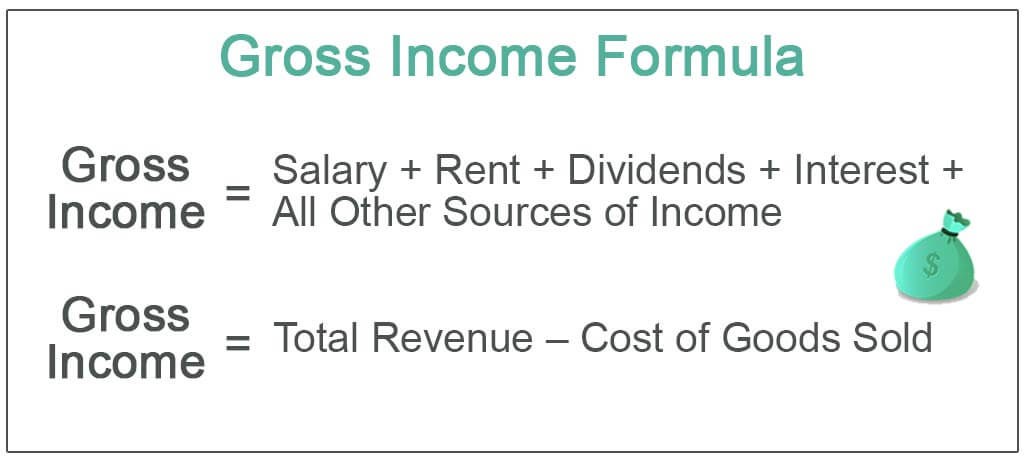

Gross income the sum of all the money you earn in a year.

. Annual Income 15hour x 40 hoursweek x. It involves all the incomes of an individual from all. Gross vs Net Income.

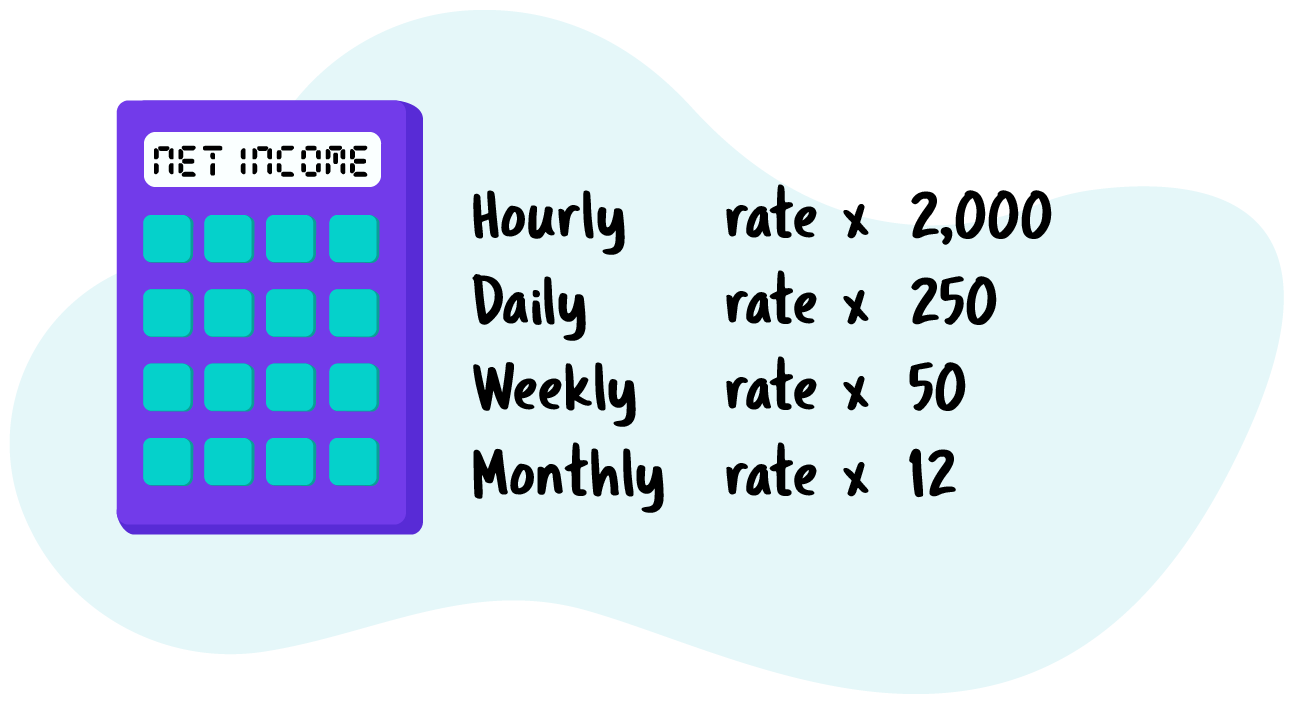

Enter the gross hourly earnings into the first field. Lenders take your monthly gross income and debt payments and calculate your debt-to-income ratio. Gross income is an individuals income earned the total income on a paycheck before the taxes and others are deducted.

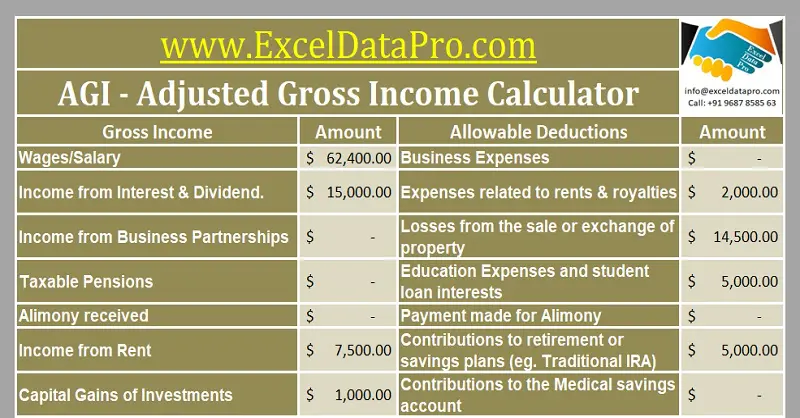

It may come in handy. Next take the total hours worked in a year and multiply that by the average pay per hour. The algorithm behind this adjusted gross income calculator performs the following steps.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Gross income per month.

Adds all the amount form the deductions. Adds all the values from the income sources specified. Total Gross per year.

AGI gross income adjustments to income. Read the fine print. This yearly salary calculator will calculate your.

How Income Taxes Are Calculated. Try the Fun Stuff. How to calculate annual income.

You can calculate your AGI for the year using the following formula. 1850 x 22 40700. The calculator calculates gross annual income by using the first four fields.

You must calculate the gross total income under the different heads of income. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Using the annual income formula the calculation would be.

Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. How Your Paycheck Works. Net income 1 - deduction rate For example if your net income was.

She decides to use the gross income formula for salary. Income Calculator Estimates your weekly bi-weekly monthly and yearly income. Your debt-to-income ratio represents the maximum amount of your monthly gross.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. This salary calculator estimates total gross. And is based on the tax brackets of 2021 and.

Victoria needs to calculate her gross income per month to determine if she can afford it. But calculating your weekly take-home pay. With five working days in a week this means that you are working 40 hours per week.

All other pay frequency inputs are assumed to. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Calculate the Gross Total Income.

It is mainly intended for residents of the US. To convert from your net annual income to your gross annual income you can use this simple formula. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

How To Calculate Total Revenue In Accounting Formula More

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

My Salary Calculator Online 52 Off Www Ingeniovirtual Com

Salary Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Annual Income Calculator

Monthly Income Calculator Online 52 Off Www Wtashows Com

Income Calculator Sale 54 Off Www Ingeniovirtual Com

Gross Income Formula Step By Step Calculations

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Gross Income Formula Calculator Examples With Excel Template

Annual Income Calculator

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

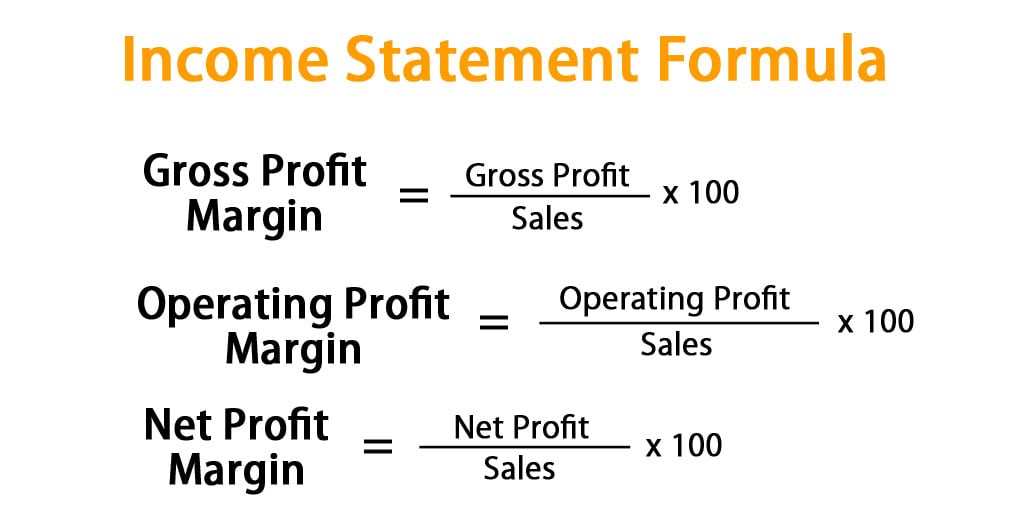

Income Statement Formula Calculate Income Statement Excel Template

Annual Income Definition Calculation And Quiz Business Terms

Download Adjusted Gross Income Calculator Excel Template Exceldatapro